Is inflation always and everywhere a monetary phenomenon, or merely a monetary policy phenomenon? The standard formula of Monetarism predicts the former1, Market Monetarism the latter.

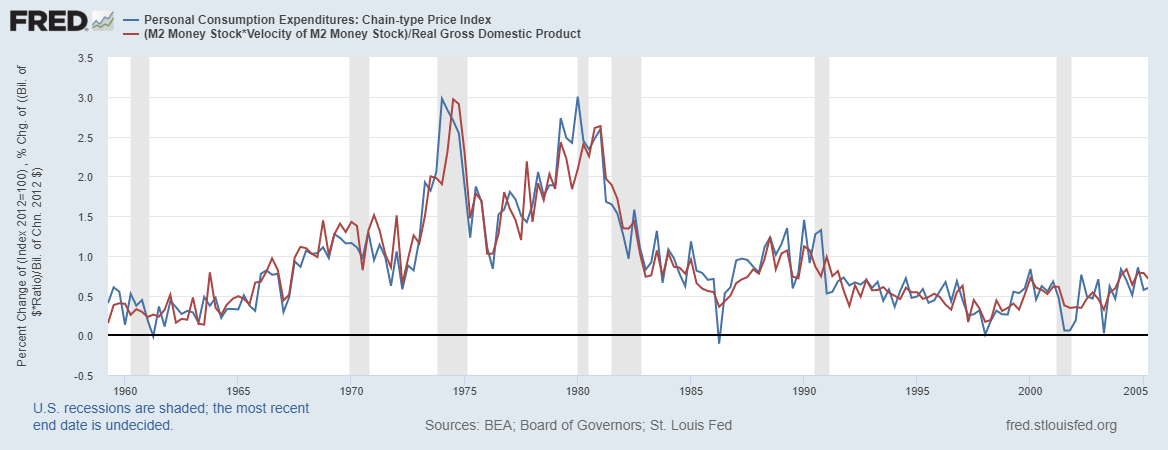

A cursory glance at M2 and inflation shows no correlation. I ran an exponentially weighted moving average on the variables, however, and got this (this the same procedure Lucas ran in his quantity theory paper2):

My R^2 was 0.754. You’ll notice the greater correlation and then decoupling. What gives?

There’s a couple issues with simply believing M2 = inflation. One, M2 is partially endogenous to inflation (well, really NGDP3). When it goes up, M2 will. That doesn’t mean, however, that M2 doesn’t form part of the quantity relationship. Two, velocity plays a large factor in the relationship:

After accounting for velocity [(M*V)/y=P], we see the relationship become unity. Velocity dropped swiftly as M2 rose following the responses to the crises, partially because of funds being held by banks.

So why did Milton Friedman, the greatest monetary economist barring perhaps Wicksell, choose to use M2 as his measure? I can think of two reasons.

One is that M2 can be a good indicator. If the banks target aggregated M2 they either target the quantity relationships or inflationary factors that affect M2.

The second is that Friedman preferred the divisia of M24. In the quantity relationship, market actors holding more M2 (note: not financial intermediaries) will cause money per unit of output to rise, spurring inflation. It used to be aggregate M2 was a good measure of this. Not anymore.

Friedman, Milton. 1956. “The Quantity Theory of Money — A Restatement.” In The Optimum Quantity of Money and Other Essays, published 1969. MacMillan and Company Limited.

Lucas Jr, Robert E. “Two Illustrations of the Quantity Theory of Money.” The American Economic Review 70, no. 5 (1980): 1005–1014. issn: 00028282. http://www.jstor.org/stable/1805778.

Sumner, Scott. 2015. “Everything's Endogenous.” EconLog. https://www.econlib.org/archives/2015/10/everythings_end.html.

Barnett, William A. 2016. “Friedman and Divisia Monetary Measures.” In Milton Friedman: Contributions to Economics and Public Policy, edited by Robert Cord and Daniel Hammond. Oxford University Press.

You need to read Dr. Philip George, "The Riddle of Money Finally Solved"

http://www.philipji.com/riddle-of-money/

M2 contained non-M1 components which are contractionary. An increase in time deposits destroys money velocity.