Here are a couple more reasons why we aren’t about to overheat.

The Fed will perform monetary offset if inflation becomes excessive. The Fed has a proven track record of quashing inflation, considering we have been below our (quite low) 2% target since the Great Recession and below 6% for 30-odd years! If need be, the Fed can Volcker the economy, although it will likely be only an expectations change that is needed.

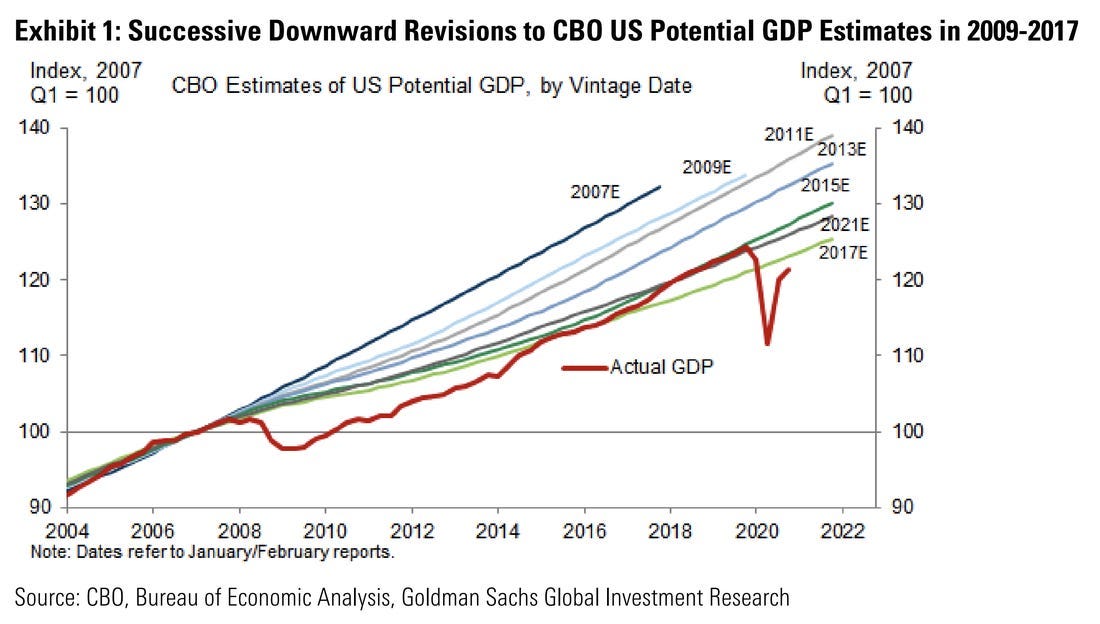

The output gap is big, and we won’t fill it with the stimulus we just passed. Without the gap being filled, there won’t be inflation. The output gap has been revised down so many times since 20071, and with a multiplier of less than one, the stimulus won’t plug it to cause inflationary pressure.

Demand for money will continue to increase as the economy reopens. We’re about to see a roaring-twenties level of consumption. That requires money and relief now.

The “disaster relief” aspect of the stimulus bill means it won’t increase economic activity and will instead set up the consumption I mention in point 3.

Global Treasury markets have remained stable, as well as other market indicators. Treasury markets are especially significant as the sale of Treasuries ostensibly fuels the stimulus bill.

The NGDP gap exists, indicating that monetary policy still has a way to go.